AMERICAN MIDDLE CLASS

Gone, but not Forgotten?

AMERICAN MIDDLE CLASS

The American Middle Class is Under Pressure

The middle class — once the backbone of U.S. prosperity — now makes up just 51% of households, down from 61% in 1971.

Rising costs, stagnant wages, and record debt are eroding financial stability for millions.

From the gas pump to the grocery store, the numbers don’t lie—rising costs, stagnant wages, and growing debt are creating a squeeze that many families can feel.

This isn’t just a passing phase; it’s a structural challenge that demands awareness and action.

Heads up, the Warning Signs Are ALREADY HERE!

• Cost of Living Outpacing Income – Essentials like housing, healthcare, and education are climbing faster than wages.

• Debt on the Rise – Credit card balances and loan defaults are hitting levels that strain household stability.

• Savings Erosion – Emergency funds are shrinking, leaving families more vulnerable to unexpected shocks.

• Job Market Shifts – Automation, outsourcing, and industry change are reshaping career security.

Be Proactive: The Numbers Behind America’s Middle‑Class Squeeze

Economic Warning Signs We Can’t Ignore

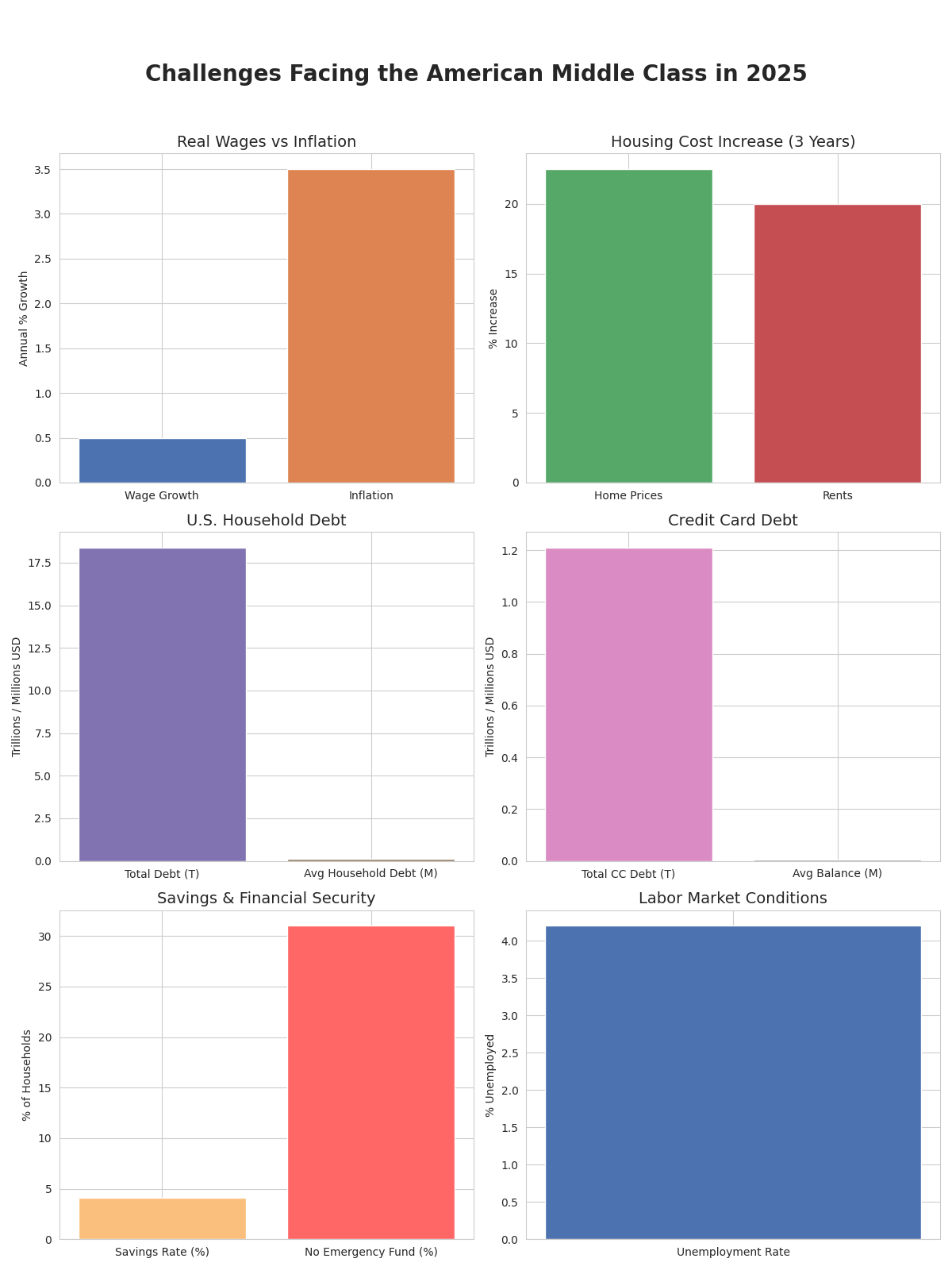

| Indicator | Latest Data (2025) | Why It Matters |

|---|---|---|

| Cost of Living vs. Wages | Real wages have grown <0.5% annually over the past decade, while inflation averaged 3–4% in 2024 | Purchasing power is shrinking, forcing families to stretch budgets for essentials. |

| Housing Costs | Median home prices in many metros up 20–25% in 3 years; rents following similar trends | Homeownership and affordable rentals are slipping out of reach. |

| Debt Load | U.S. household debt at $18.39T; average household owes $105,056 | High debt plus rising interest costs drain monthly cash flow. |

| Credit Card Strain | Total credit card debt: $1.21T; average balance: $6,371 | High‑interest debt compounds financial stress. |

| Savings Shortfall | Personal savings rate: 4.1%; 31% of Americans lack even 1 month’s emergency funds | Limited safety nets leave families vulnerable to shocks. |

| Job Market Shifts | Hiring has cooled; unemployment at 4.2% with signs of a softening labor market | Career stability is less certain, especially in disrupted industries. |

At Support Circle Network, we believe in the power of knowledge.

Steps to Improve Your Circumstances

• Audit & Adjust – Track every expense; cut recurring costs that don’t serve your priorities.

• Reduce High‑Interest Debt – Target credit cards and personal loans first to free up cash flow.

• Boost Your Safety Net – Automate small, regular transfers to savings; aim for 3–6 months of expenses.

• Upskill for Resilience – Certifications, digital skills, and industry‑specific training can open higher‑paying roles.

• Leverage Community Strength – Join networks like Support Circle Network to share resources, strategies, and opportunities.

Audit your Lifestyle & Well-being

- Here is a laser‑precise, practical, and doable roadmap that anyone can put into action, whether you’re starting with $20 or $20,000.

These steps are designed to be within reach, not just “good in theory,” and they work in a weathered economy because they focus on control, resilience, and leverage.

1. Get a Clear, Unflinching Picture of Your Finances

• Track every dollar for 30 days — use a free app or a notebook.

• Separate needs vs. wants — this alone often reveals 10–20% in reclaimable cash flow.

• Identify your 3 biggest recurring costs and see if they can be reduced, paused, or replaced.s are designed to be within reach, not just “good in theory,” and they work in a weathered economy because they focus on control, resilience, and leverage.

2. Build a Micro‑Safety Net First

• Goal: $500–$1,000 emergency buffer before tackling big investments.

• Use “found money” — tax refunds, side gig income, selling unused items — to seed it.

• Keep it in a separate, easy‑access account so it’s not accidentally spent.

3. Attack High‑Interest Debt Relentlessly

• Focus on credit cards, payday loans, or anything over 10% APR.

• Use the debt snowball (smallest balance first) for motivation or avalanche (highest interest first) for math efficiency.

• Even an extra $25–$50/month toward principal can shave months off repayment.

4. Increase Income in Small, Repeatable Ways

• Sell skills, not just time — tutoring, repair work, design, writing, delivery driving.

• Offer services in your local trust network first — neighbors, friends, community boards.

• Reinvest a portion of extra income into your safety net or skill growth.

5. Invest in Skills That Pay Back Quickly

• Look for low‑cost or free certifications (Google, Coursera, local workforce programs).

• Target skills with direct earning potential — bookkeeping, digital marketing, trades, coding basics.

• Apply new skills immediately, even in small freelance or part‑time roles.

6. Reduce Dependency on Volatile Costs

• Food: Cook at home, batch prep, join a local co‑op or community garden.

• Energy: Lower thermostat 2–3 degrees, unplug unused electronics, explore efficiency rebates.

• Transportation: Carpool, combine errands, and maintain your vehicle to avoid costly repairs.

7. Build or Join a Support Network

• Share resources, referrals, and opportunities.

• Partner on bulk purchases to cut costs.

• Exchange skills — childcare for tutoring, repairs for meals, etc.

8. Keep a “Proactive Playbook”

• A one‑page list of:

• Your monthly essentials cost

• Your emergency contacts & resources

• Your top 3 income‑boosting options

• Review quarterly and adjust as life changes.

Why this works:

These steps don’t depend on market timing, political shifts, or large capital. They’re behavior‑driven, compounding, and adaptable — meaning they work whether you’re in survival mode or building long‑term wealth.

Join The Private Community

How You Can Join The Movement

Join the Support Circle Network today!

Make Extra Money with YOUR OWN 360 Shopping LIVE Booth!

Looking For Extra Income?

- Looking to boost your income or grow your business/service? Support Circle Network offers innovative solutions to help you earn money without dealing with all the scam artists, whether you're an entrepreneur, a small business owner, or just retired and looking for a way to make extra money without worrying about how to start. We have a unique opportunity for teachers and social workers as well.

Are you a Licensed Professional?

Ready to Lead the Future of Care and Education?

Step into a new era where licensed professionals—educators, social workers, counselors—transform lives far beyond their local communities. By blending your expertise with AI-enhanced tools, you can deliver high-quality, personalized support online while keeping your values of trust, empathy, and integrity at the forefront.

We’re inviting professionals like you to become owner-operators of innovative, inclusive online services—combining human insight with cutting-edge technology to scale your reach and deepen your impact. Join a growing network that respects your credentials and empowers your vision.

360 Shopping LIVE: Your Path to Enhanced Profitability

-

Our flagship 360 Shopping LIVE program is a game-changer for anyone wanting to sell products or services online. Imagine connecting with customers face-to-face, no matter where you are, using just your phone! That's the power of 360 Shopping LIVE.

For a booth rental starting at just $159.00 a month, you get unlimited LIVE Video Chat. This means you can provide instant, personalized support to your customers, leading to:

- Higher Sales: Direct interaction builds trust and helps close deals.

- Fewer Returns: Customers get their questions answered in real-time, ensuring they make informed purchases.

- Ultimate Flexibility: Connect with customers from your home, your studio, or even on the go – no need to be tied to a physical shop.

Ready to see how it works? Learn more about 360 Shopping LIVE here!

More Ways to Boost Your Income with Support Circle Network

-

Beyond the direct sales power of 360 Shopping LIVE, we empower you with tools and help you with traffic to maximize your earning potential:

- Free AI-Powered Marketing Tools: We provide cutting-edge AI tools to help you reach your ideal customers without extra cost:

- DIY AI Marketing Prompts: Generate effective marketing copy and ideas in minutes.

- AI Graphic Design: Create stunning visuals for your products and promotions, even if you're not a designer.

- Video Clips (Reels) for AI Creatives: Easily produce engaging short-form videos for social media.

- Targeted Social Media Insights: Our AI will even tell you where your best customers are spending their time online (YouTube, TikTok, and more!).

- Built-in Traffic Generation: We actively drive potential customers to your virtual booth! Our Targeted Video Ad Campaigns on YouTube and TikTok are designed to bring interested buyers directly to the Support Circle Network platform, increasing your visibility and sales opportunities.

- Ideal for Small Businesses & Entrepreneurs: If you're a small business owner with limited resources looking to establish or enhance your online presence, our virtual shopping show offers a cost-effective and highly efficient solution. It's an online storefront with built-in customer engagement and marketing support.

Who Can Benefit?

- Crafters & Artisans: Showcase your unique creations live, demonstrate your craft, and answer customer questions instantly.

- Boutique Owners: Offer a personalized shopping experience, highlighting new arrivals and styling tips.

- Service Providers: Consult with clients live, offer virtual tours, or provide demonstrations of your services.

- Coaches & Educators: Host interactive Q&A sessions or mini-workshops to engage with potential clients.

- Anyone with a Product or Service: If you can sell it, you can showcase it on 360 Shopping LIVE!

Our Network